FAQ: Paycheck Protection Program

Posted On |

Image

|

The Paycheck Protection Program's (PPP) goal is to keep workers on payroll and will cover certain operating expenses, including mortgage interest, rent, utilities and payroll costs. The SBA will forgive the loan proceeds used to cover the first eight weeks of eligible costs. We encourage businesses to review the available information from the SBA and reach out to their current financial institution.

QUICK LINKS

SBA's Paycheck Protection Program page

SBA's PPP FAQs

SBA List of Participating Lenders

750 Lenders (within the SBA's Syracuse District Office 34-county coverage area)

Where do I apply?

Any existing 7a lender (see the SBA's Find a Lender tool, or this list of lending institutions within the SBA's Syracuse District Office 34-county coverage area), or most banks and credit unions will process applications. Lenders are responsible for approvals. There is no separate application to the SBA necessary.

Who is eligible?

All businesses, including nonprofits (501(c)3s), Veterans organizations, Tribal concerns, faith-based concerns, sole proprietorships, self-employed individuals, and independent contractors, with 500 or fewer employees, or no greater than the number of employees set by the SBA as the size standard for certain industries.

Is this the same as the forgiveness program?

Yes, if proceeds are used in the eight weeks from loan funding for payroll costs and other designated business operating expenses and the company brings back total employees and payroll to pre shut down levels. Portions of the loan not forgiven will be treated as 7a debt under the terms of the PPP program.

Can I combine this program with the SBA’s Economic Impact Disaster Loan?

Yes, but you cannot apply for the same expenses to be covered – pending EIDL loans can be modified to reflect a PPP application.

What are the Terms?

- Interest rate of 1.0%

- Maturity of two years

- First payment deferred for six months

- 100% guarantee by SBA

- No collateral

- No personal guarantees

- No borrower or lender fees payable to SBA

What if I have an existing SBA 7a loan?

The SBA is covering all principal and interest on existing 7a loans for 6 months. You may also apply for a PPP loan.

Can business owners who don’t traditionally take payroll but take income out of the profit of the business be counted?

Yes, that profit that is reported on an owner’s personal income tax can be counted towards payroll

Are 1099 or contract based workers counted?

No, they are not considered employees and therefore cannot be counted

Are banks accepting PPP applications from non-clients?

Yes, some banks are currently taking PPP applications from non-clients. Email support@centerstateceo.com for the list.

When can a sole-prop apply for a PPP loan?

Sole proprietors can apply on Friday, April 10.

Can a business apply if they are deemed non-essential?

Yes, a business that had to lay off its staff and close because it was considered non-essential can apply to re-hire its staff.

Can companies owned by a foreign entity apply?

Yes, companies with at least 51% domestic ownership can apply.

How much of a loan is forgivable?

Up to 8 weeks of actual payroll for employees hired back during the first 8 weeks of the loan term may be forgiven. Loan proceeds used for other eligible expenses (rent, mortgage interest, utilities, etc) may not constitute more than 25% of the forgiven amount.

Other

CEO News

CEO News | 02/06/2026New Benefit Gives Members Access to Speakers Through TalkadotCenterState CEO is excited to introduce a new member benefit through a partnership with Talkadot (www.talkadot.com), a data-driven speaker booking platform. CenterState CEO members now have unique access to Talkadot, providing a… |

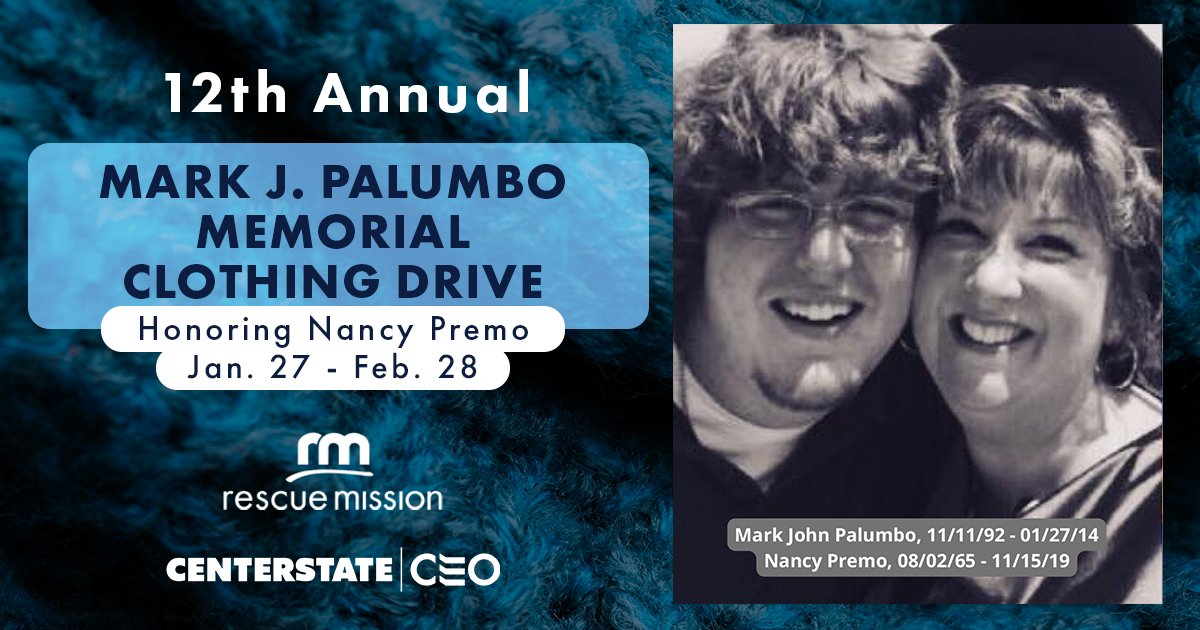

CEO News | 01/16/202612th Annual Mark J. Palumbo Memorial Clothing Drive, honoring Nancy PremoCenterState CEO is hosting the 12th annual Mark J. Palumbo Memorial Clothing Drive in honor of Nancy Premo. Bring gently used items such as winter coats, hats, sweatshirts, gloves, scarves, sweaters and warm socks to CenterState CEO's… |