CenterState Signal: Syracuse Delivers

Posted On |

Image

|

The first headline-grabbing economic news of 2025 arrived in the form of the Q1 GDP estimate, offering an early glimpse into how the economy is responding to a new administration and its anticipated policy shifts. Following a prolonged period of positive GDP growth since Q1 2022, the economy contracted by 0.5% compared to the previous quarter. While a single-quarter drop in GDP doesn’t constitute a recession on its own, it can be a warning signal—particularly when coupled with weakening consumer confidence, tightening credit conditions, or softening labor markets.

A sharp increase in imports (likely driven by tariff expectations) contributed to challenges in measuring GDP (NYT explains it here). But the straightforward takeaway is this: In Q1, consumer spending slowed, while imports and business investment jumped, likely in anticipation of new tariffs being debated by the administration.

The information sector, buoyed by a spike in computer equipment purchases, contributed positively to GDP, adding 0.56 percentage points. Real estate, rental, and leasing also posted modest gains of 0.66 points. But most other sectors saw declines, reflecting a broader cooling across goods and services. Meanwhile, mixed signals from consumer confidence surveys and ongoing uncertainty around tariffs, inflation, interest rate policy, and the resilience of the American consumer continue to cloud the economic outlook.

Unsurprisingly then, the Fed’s new favorite word is “uncertainty.” According to those who keep records of such things, the chair of the New York Fed used the word “uncertain” 12 times in a recent speech.

Still, even with “persistent uncertainty” looming over the broader economic narrative, CenterState CEO members reported strong performance in 2024 and a confident outlook for 2025—an outlook supported by solid job growth, low unemployment, and continued interest in investment in the first two quarters of 2025.

The Year Started with Confidence

At the start of 2025, we released our Economic Forecast Report, and the results were telling:

- 73% of member businesses expected above-average performance this year—up 20 points from last year.

- 77% anticipate revenue growth, and

- 65% are betting on innovation to drive it.

Moreover, recapping our 2025 Outlook from the Economic Forecast report:

- 52% of respondents reported capital investments would increase in 2025, and

- 63% reported that hiring would increase in 2025

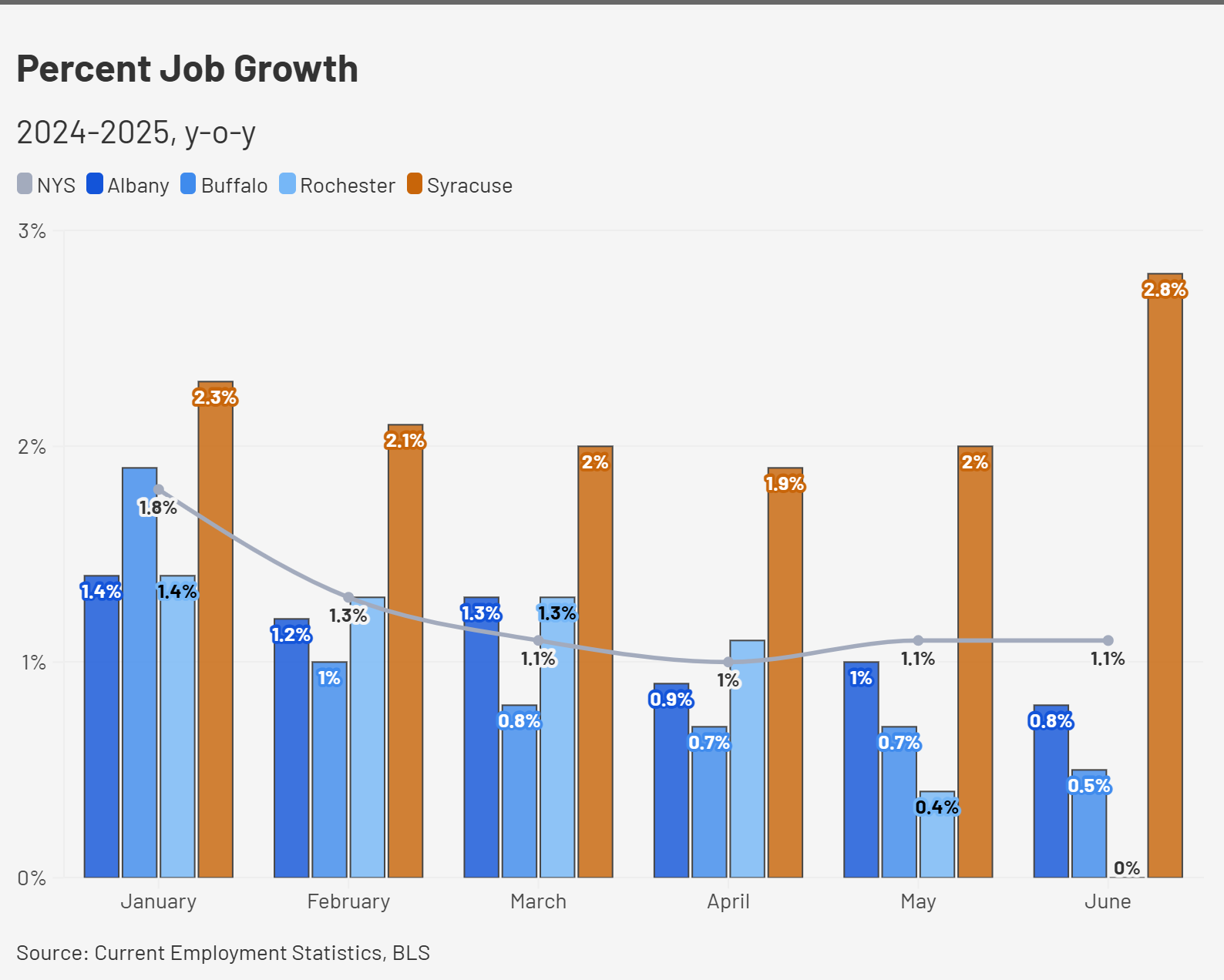

What the Data Tells Us – Syracuse is Where Job Growth is Happening in New York State

Our region’s job numbers in 2025 back up the positive sentiment. In each month (January to June) in 2025, the Syracuse MSA has consistently been at about a 2% growth or above over the previous year in that month. As of June, we had an increase of 7,300 jobs year-over-year, representing a 2.8% rise over the same period last year. Syracuse continues to have the strongest job growth in any upstate metro, and leads in NYS job growth overall. In most months this year, Syracuse has led all metro areas in New York State in job growth.

Optimism isn’t abstract. It’s showing up in investment decisions, from solo entrepreneurs to advanced manufacturers:

- Lindsay Mastrogiovanni, founder of Conscious HR, just opened a co-working office in downtown Syracuse, building space for others to grow alongside her.

- TTM Technologies is constructing a new campus and preparing to onboard 400 family-sustaining jobs.

- Startek Lighting America is consolidating operations, investing in innovation, and expanding its workforce.

- Zach Primo, who runs a growing signage business, is planning new capital investments to meet demand.

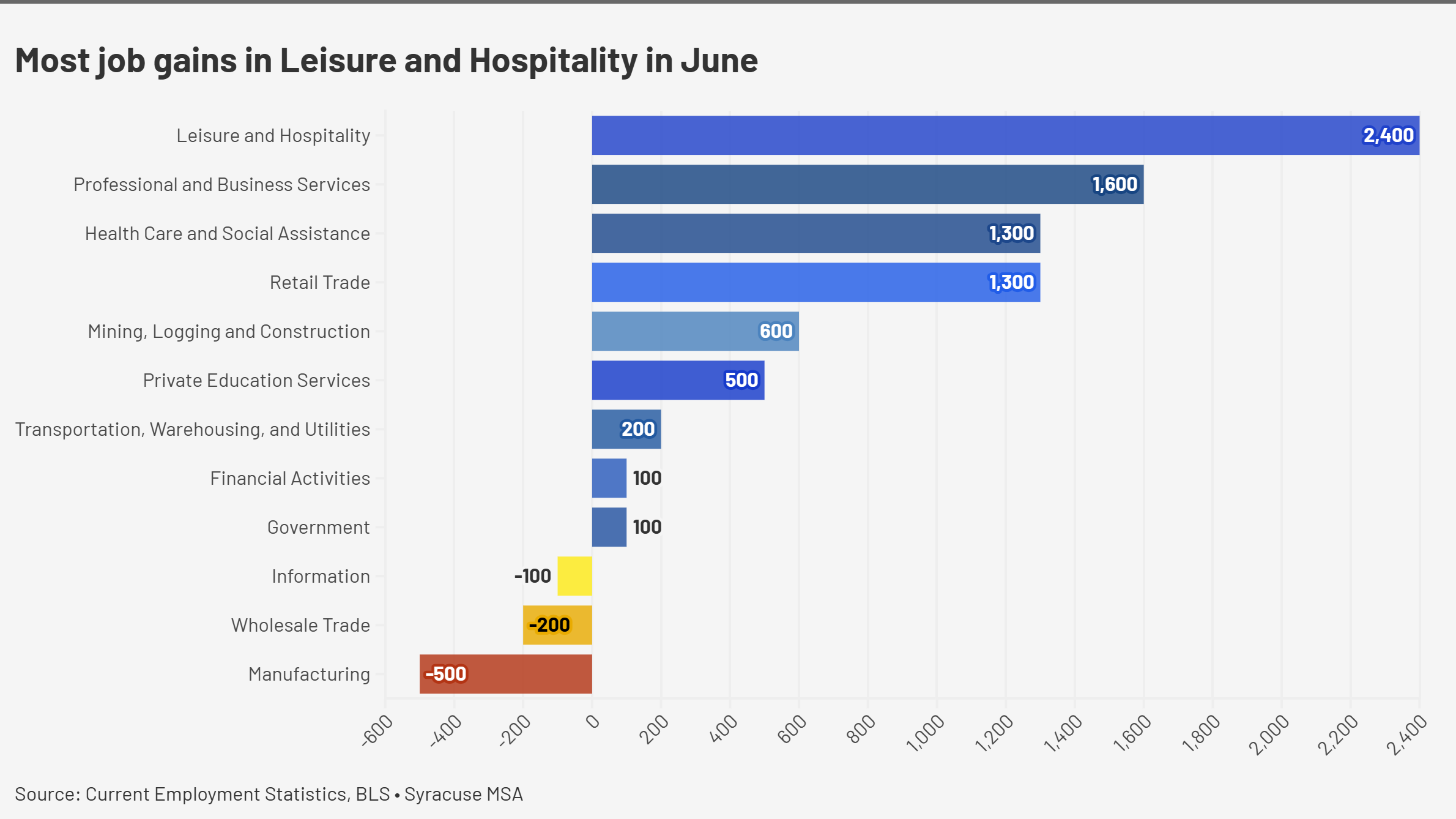

Employment is rising across multiple sectors, led by substantial gains in Leisure and Hospitality. Retail, responding to consumer uncertainty, is adapting by emphasizing service-oriented, experience-driven offerings to sustain demand. As Vice President of Member Engagement Jess Abbott noted in our recent Talk CNY podcast, COR Development has embraced this shift—bringing in tenants like food halls, entertainment venues, and community spaces that offer more than just products. The strategy appears to be working: in June, Retail jobs grew by 1,300 year-over-year, signaling strong consumer demand and a steady pace of new openings across restaurants, hotels, and attractions.

From Caution to Acceleration

In a year of dramatic uncertainty in the national economy, we may not have the loudest headlines, but we've got the strongest signal. And if you're trying to figure out where the future is taking shape, watch what's happening in Central New York.

Other

CEO News

CEO News | 02/06/2026New Benefit Gives Members Access to Speakers Through TalkadotCenterState CEO is excited to introduce a new member benefit through a partnership with Talkadot (www.talkadot.com), a data-driven speaker booking platform. CenterState CEO members now have unique access to Talkadot, providing a… |

CEO News | 01/16/202612th Annual Mark J. Palumbo Memorial Clothing Drive, honoring Nancy PremoCenterState CEO is hosting the 12th annual Mark J. Palumbo Memorial Clothing Drive in honor of Nancy Premo. Bring gently used items such as winter coats, hats, sweatshirts, gloves, scarves, sweaters and warm socks to CenterState CEO's… |