CenterState Signal: Syracuse Job Growth Hits 25-Year High

Posted On |

Image

|

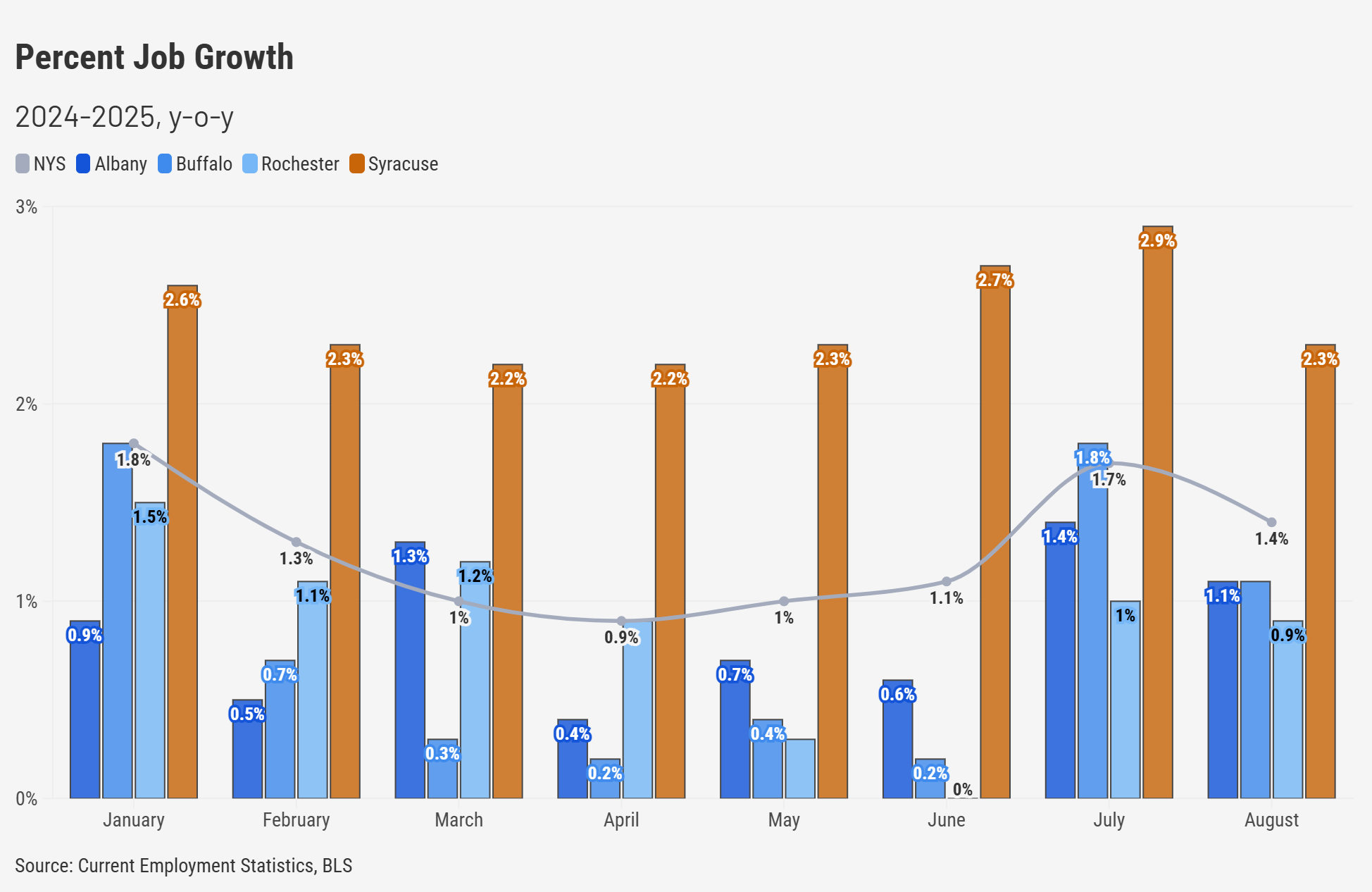

Frustrated by economists who refused to commit to a clear view, Harry Truman once quipped that he wanted “a one-handed economist.” And while uncertainty has been the defining feature of the national economic story in 2025, we’re looking for firmer ground as we enter the final quarter. At a time when the national labor market appears to be losing steam, Syracuse is quietly delivering one of its strongest periods of job growth in decades, all before planned site work begins in Clay for Micron in November.

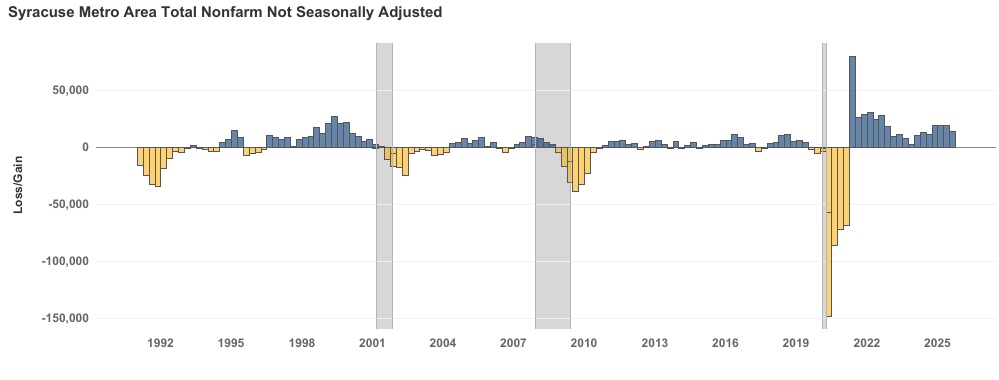

While U.S. growth remains supported by resilient consumers and steady business investment, hiring has slowed as employers grow cautious. Here in Central New York, however, employment has surged 2–3% year over year, adding 6,000 to 8,000 jobs primarily in education and health care, leisure and hospitality, retail, and business services. Other than the immediate post-pandemic rebound, Syracuse hasn’t seen sustained gains of this level since the late 1990s, a period defined by a nationwide jobs boom. This underscores just how unusual and significant today’s expansion is.

National Outlook

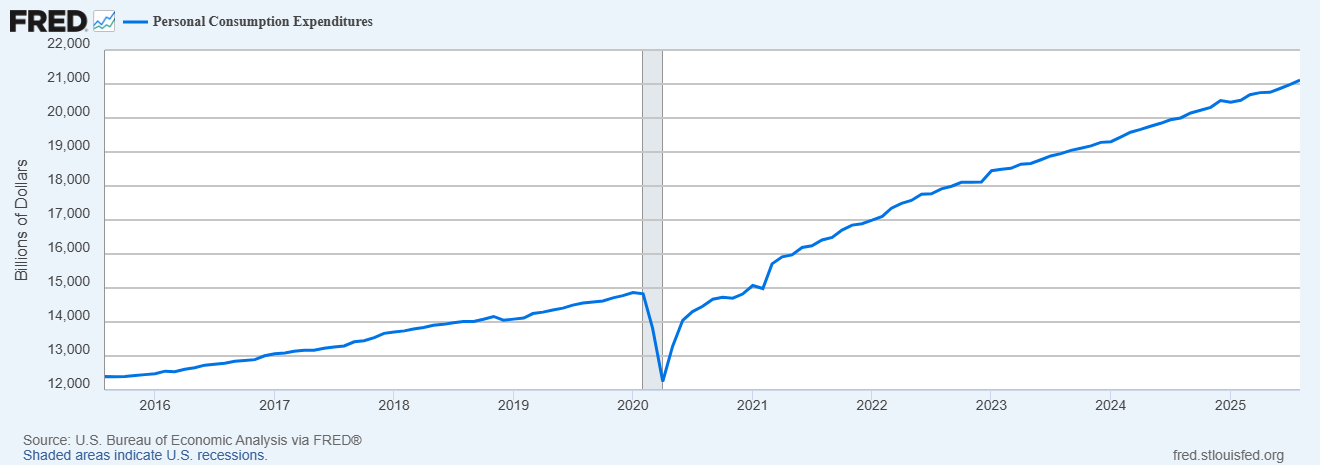

Consumers have continued to spend throughout 2025, despite persistent price pressures. Though there was a drop in Q2, businesses are still investing, albeit more cautiously, and expectations are rising for a shift toward lower interest rates in 2026. Yet beneath those positive signals, questions linger: Will the labor market weaken further? Will tariffs weigh on growth and push inflation higher? And how much patience will the Federal Reserve show as it tries to balance jobs and price stability?

Never Underestimate the Hedonism of the U.S. Consumer

Consumer sentiment dropped sharply at the start of 2025, partly due to concerns about the impact of new tariff policies. As strong inflation began to cool in late 2024, tariff policies raised worries about new cost increases and potential shortages that could lead to broader economic slowdowns. Despite the uncertainty, and flagging consumer sentiment, personal consumption expenditures continued to expand, driven by retail and services.

Chief Economist for UBS Paul Donovan in his Snickers Bar explanation, reminds us that “whatever consumers may feel about the damage of inflation, they will still spend the money that they have. The mantra ‘Never underestimate the hedonism of the U.S. consumer’ continues to hold good.”

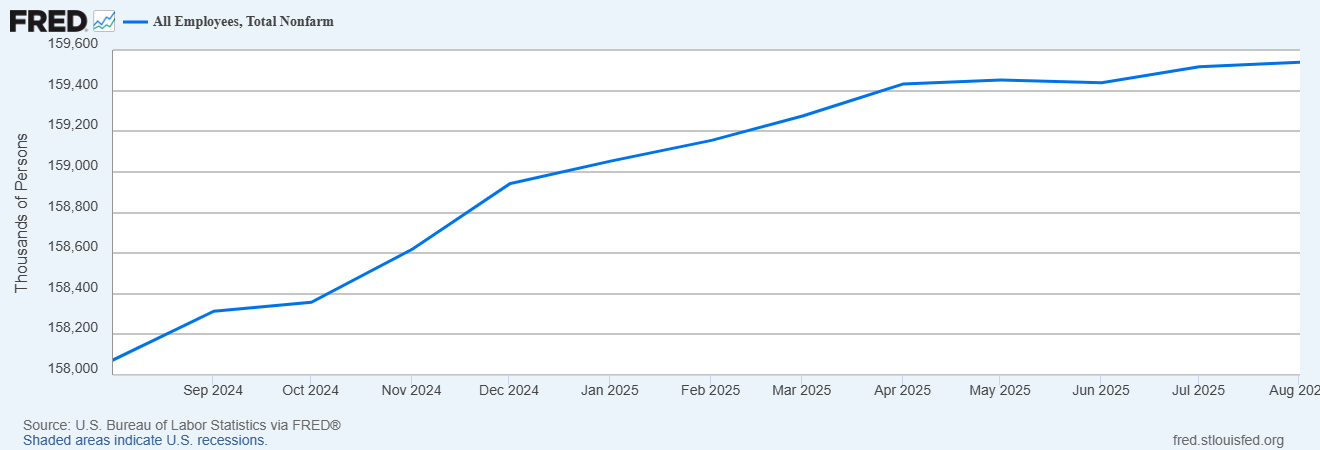

On The Other Hand…The Labor Market is Showing Signs of Weakness

Despite continued consumer and business strength, the labor market is showing clear signs of slowing. Syracuse is an exception to this (more on that below). Hiring dropped sharply in August, and revised data now show job losses in June, a potential early sign that the labor market is losing steam.

U.S. nonfarm payroll employment was essentially flat in August and has remained primarily unchanged since April, according to the Bureau of Labor Statistics. The unemployment rate held steady at 4.3%.

Federal Reserve Chairman Jerome Powell cited a “shift in the balance of risks” as part of the Fed’s decision to lower rates by a quarter point. With concerns about full employment playing a greater role in the Fed’s decision-making on interest rates, many are expecting further rate cuts in 2026.

Syracuse: A one-handed economy in 2025?

If there’s one question we’ve heard more than any other in 2025, it’s: “What’s next with Micron?”

The short answer: we’re closer than ever to a historic inflection point. With the Draft Environmental Impact Statement (DEIS) public hearings now complete, a significant new presence established in downtown Syracuse and site work scheduled to begin in November, Central New York stands on the eve of one of the most significant private investments in the country’s history.

But perhaps the most remarkable story is what’s happening before the first shovel hits the ground at White Pine. The Syracuse regional economy is already delivering some of the strongest year-over-year job gains on record, and billions of dollars in private and public investment are flowing into the region.

We shared a similar chart last quarter, but now, with more than half of the year’s job data reported, we can show that job gains in Syracuse have spanned three quarters and are two to three times above job gains in other large upstate metros and compared to all of New York as a whole.

To gain a full appreciation for the strength of the year-over-year job growth in 2025, we must go all the way back to 1999, when Ricky Martin topped the Billboard 100 with “Livin’ la Vida Loca.” The chart below places our recent (farthest right) year-over-year job growth in the context of over 35 years of job change in our region. The areas in yellow, below the axis, represent months when the number of jobs in Syracuse was lower than in the same month of the previous year. The areas of blue show an increase. This year’s job change is higher and more sustained than anything we’ve seen since the 1990s, other than the year after the COVID-19 pandemic.

Homes are Where the Jobs Sleep at Night

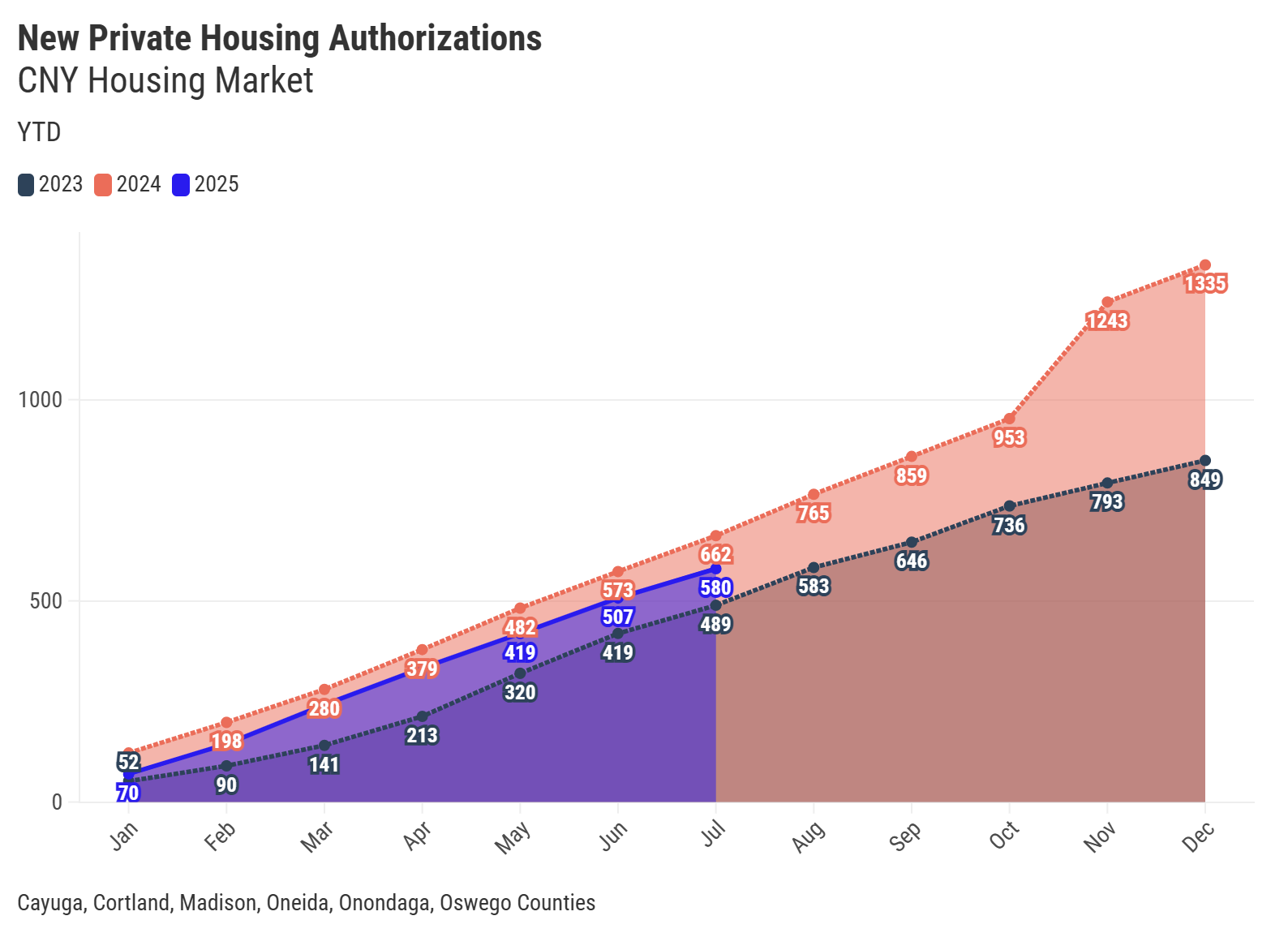

Central New York’s historic job growth is fueling an unprecedented wave of housing activity, with more than $4 billion in proposed investment and over 12,000 new units in the development pipeline to meet rising demand. And with the Federal Reserve beginning a rate-cutting cycle expected to extend through 2026, conditions are improving for residential developers to advance these projects.

Through our Housing Work Group, CenterState CEO has been tracking residential development throughout the region, including those recently completed and those moving from planning to groundbreaking:

Completed:

- Camillius Mills II – 46 units

- Moyer Carriage Lofts – 128 units

- Symphony Place – 75 units

- The St. Matthew’s Condos – 21 units

In Construction:

- The Chimes Building – 152 units

- The Rosie – 286 units

- Crowne Plaza Redevelopment - 287 Units

- Syracuse Developmental Center – 600 Units

Meanwhile, building permits for new construction (excluding rehabilitation) are keeping pace with last year’s elevated levels, which were already 57% higher than in 2023, underscoring sustained momentum in housing production.

Together, these trends paint a clear picture: while national signals point to a more cautious phase of the economic cycle, Central New York is not merely holding steady — it’s accelerating. The region’s sustained job growth, rising investment, and surge of new housing construction all point to a local economy that is expanding its capacity before Micron’s arrival. That momentum positions Syracuse not just to benefit from the coming semiconductor boom but to leverage it as a catalyst for long-term growth, opportunity, and transformation.

As we look at the year ahead, we’re interested to hear your expectations for the economic climate in 2026, and trends impacting your business and industry. We invite you to take our annual Economic Forecast Survey, to help inform our regional planning and analysis. Data collected from the survey is used to develop CenterState CEO’s Economic Forecast Report of Central New York, released in January 2026, and to inform future installments of CenterState Signal with your perspectives in mind.

Other

CEO News

CEO News | 02/06/2026New Benefit Gives Members Access to Speakers Through TalkadotCenterState CEO is excited to introduce a new member benefit through a partnership with Talkadot (www.talkadot.com), a data-driven speaker booking platform. CenterState CEO members now have unique access to Talkadot, providing a… |

CEO News | 01/16/202612th Annual Mark J. Palumbo Memorial Clothing Drive, honoring Nancy PremoCenterState CEO is hosting the 12th annual Mark J. Palumbo Memorial Clothing Drive in honor of Nancy Premo. Bring gently used items such as winter coats, hats, sweatshirts, gloves, scarves, sweaters and warm socks to CenterState CEO's… |