CenterState Signal: Understanding The Present to Forecast the Future

Posted On |

Image

|

It might have been Yogi Berra who said, “It’s difficult to make predictions, especially about the future.” Like a lot of Yogi-isms, there is a hidden truth in the irony: knowing the past and present sometimes isn’t much easier than making a forecast.

As we take a look at the economic data this year, it seems that predicting the future is difficult because even the present is unstable, contradictory and only partly understood. Even as we look ahead to our 2026 Economic Forecast Breakfast, describing what’s already happened in 2025 is a challenge:

- GDP flickers between recession fear and rapid growth.

- Inflation has come down, but consumer prices keep squeezing household budgets.

- Unemployment holds near record lows, yet hiring activity remains stubbornly weak.

- Consumer confidence is battered, even as retail spending refuses to slow down.

In Central New York we’ve had notable job growth in 2025, with year-over-year (YoY) levels unseen since the 1990s, alongside median wage growth surpassing 5%. While manufacturing jobs haven’t yet materialized due to project timelines, there are however early signs of job boosts from the CHIPS Act, with early impacts mostly in services and construction. Crucially, the recent job growth has occurred across both large- and small-employer sectors, a positive development that suggests the possibility of a broad-based recovery, even given the broader trend of large employers recovering faster while many small businesses continue to lag.

The concept of the "K-shaped Economy" will surely gain more attention. A K-shaped economy describes growth that accelerates for large firms and high-income households while simultaneously flattening or declining for smaller employers and middle- to lower-income households. It is most evident when we index values to a date, and the trend lines diverge.

2025-2024: Growth and Recovery

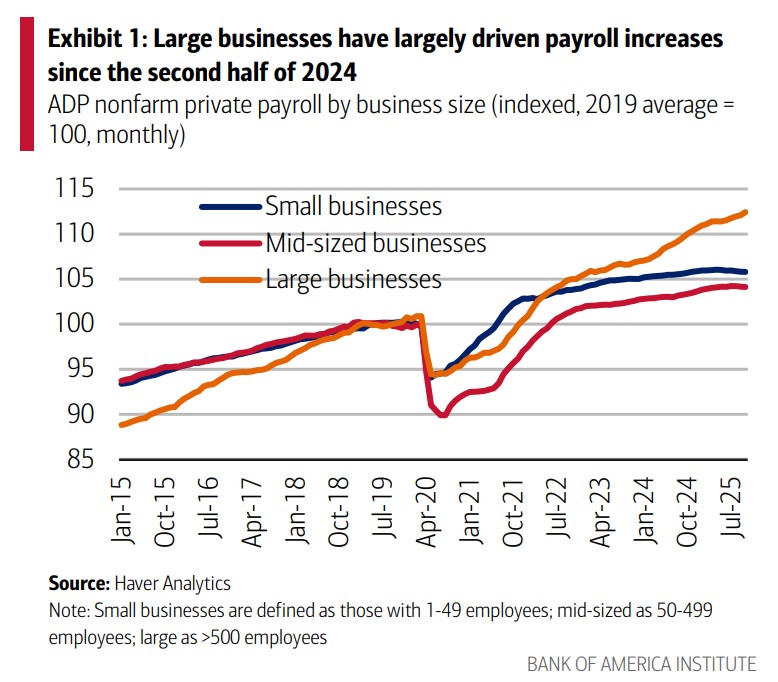

According to the Bank of America Institute, payroll growth in the U.S. since the pandemic has been driven by businesses with more than 500 employees, and since the second half of 2024, the trend has accelerated. Large companies have been driving national growth, while small and mid-sized businesses are leveling off. You can spot the “K” by focusing on the divergence that accelerates in January 2024.

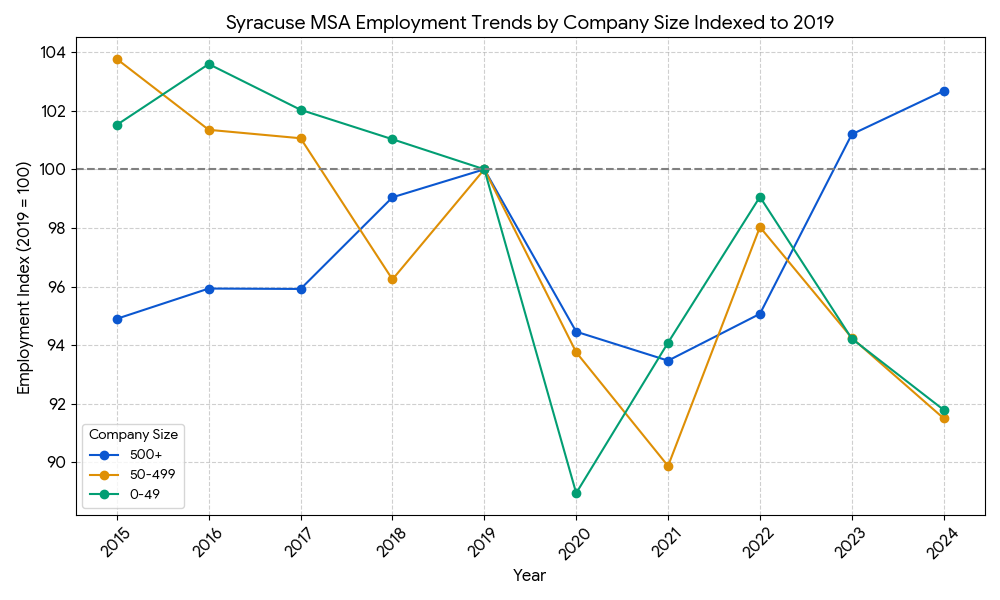

While the Syracuse MSA has demonstrated resilience by recovering jobs lost during the pandemic, the economy is becoming increasingly top-heavy. Since 2019, large employers are above pre-pandemic levels while small firms remain roughly 8–10% below.

- 500+ (Large Firms): This is the only category that has consistently risen above the 2019 level, reaching over 102.6% in 2024.

- 0-49 and 50-499 (Small and Mid-sized Firms): Both categories suffered a sharp drop in 2020 (especially the smallest firms) and have not recovered to their 2019 employment levels. As of 2024, they remain between 91% and 92% of their pre-pandemic size.

If the divergence persists, the region will see growth disproportionately driven by anchor institutions and large employers, while small commercial corridors will face slow or no growth.

The chart below shows the changes in employee levels for small, mid and large firms. The levels are indexed to the year 2019, meaning the employment level for all categories in 2019 is set to 100. After 2022, the K becomes easy to spot. Employment at large firms has recovered to levels above 2019, while smaller firms have remained below pre-pandemic levels.

2024-2025 Job Growth

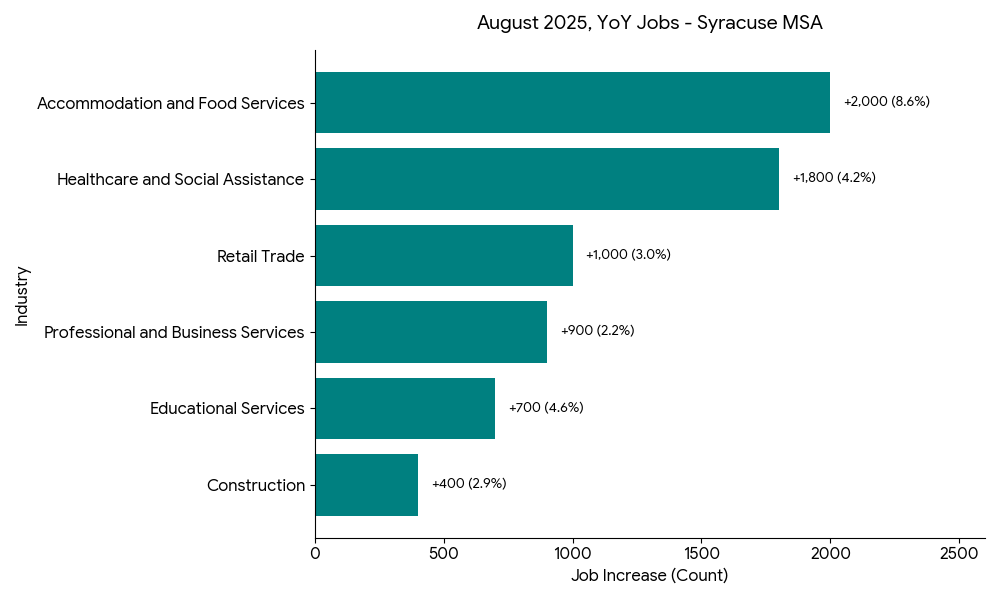

The more than 2% YoY job growth in the Syracuse MSA (2024-2025) is something we’ve reported here and shared widely. (August data is the most recent due to the federal government shutdown). The monthly employment statistics don’t include data on employment by firm size, so we’ll have to look at which sectors had job growth and compare that to where employment is concentrated by firm size.

The YoY job change varies from month to month. Still, most of the job growth in our region this year came from businesses in hospitality, health care, retail trade, professional services, education and construction.

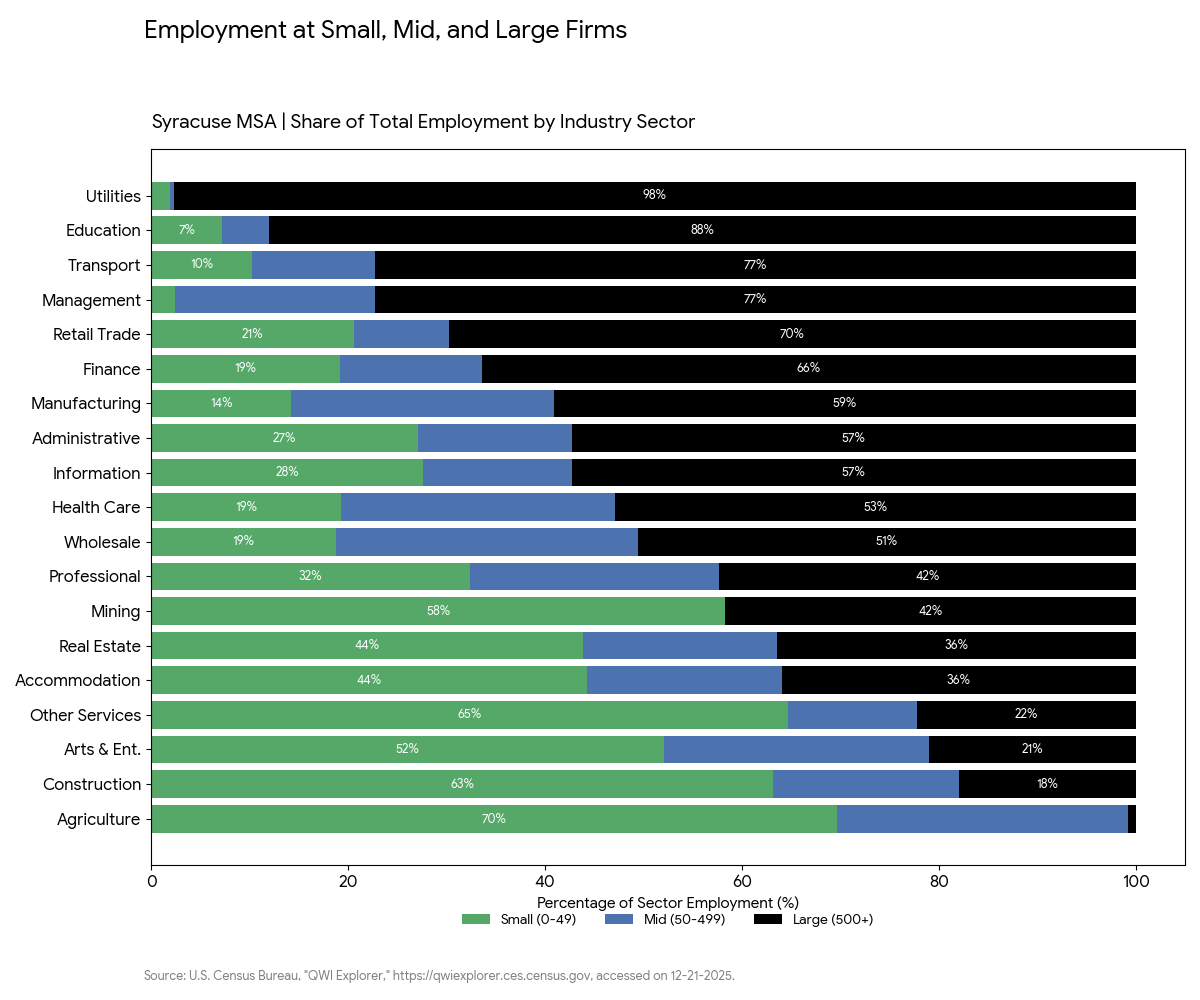

The chart below shows that industries like Accommodation and Food Services; Arts, Entertainment, and Recreation; Construction; and Real Estate and Rental and Leasing are heavily dominated by jobs at establishments with the fewest employees (0-49).

Conversely, industries such as Utilities, Educational Services, and Health Care and Social Assistance have the most significant proportions of establishments in the 500+ employee size category.

Key Takeaways

Our strongest YoY job growth is taking place in two sectors where we have small business dominance: Construction, Accommodation and Food Services, and one sector where employment is split between firm sizes: Professional and Business Services.

We also had strong job growth in sectors where large businesses dominate: Health Care and Social Assistance (+1,800 jobs), Educational Services (+700 jobs), and Retail Trade (+1,000 jobs).

Like the rest of the U.S., our economic momentum is increasingly concentrated in large employers and institutional sectors. Without intervention, the two-speed economy risks becoming permanent.

We’ve had strong job growth momentum in 2025 in some sectors that have a strong small business presence, and an opportunity to build on that momentum. CenterState CEO has already started taking action in this area. INSPYRE Innovation Hub by CenterState and the CenterState CEO Network both support small business development through intentional programming and connection.

Equity Economy & Ownership Equity

As the data indicates, ensuring that Central New York’s momentum becomes durable and broadly shared will require even more intentional action. The next stage of regional growth must create more on-ramps into ownership, wealth development and business scaling—not only employment participation.

We will be joined on Thursday, Jan. 22, 2026, at 8 a.m. at the Oncenter in Syracuse by Wilmington Trust Investment Advisors, Inc. Chief Economist Luke Tilley and Amy Liu, Nonresident Senior Fellow with the Brookings Institution to discuss results from CenterState CEO’s Economic Forecast Survey, look ahead at major 2026 economic trends, and discuss the strategic imperatives for our regional economy, which includes how we continue to support access to the economic growth that we’re already experiencing, and making sure we’re not pricing people out of prosperity.

Other

CEO News

CEO News | 03/03/2026CenterState CEO Shares Statement Congratulating Syracuse University's 13th Chancellor and PresidentCenterState CEO President and CEO Rob Simpson issued the following statement on Syracuse University's announcement naming Dr. J. Michael Haynie as its13th Chancellor and President. |

CEO News | 02/26/2026CenterState CEO Announces 2026 Business of the Year FinalistsCenterState CEO has announced finalists for its prestigious 2026 Business of the Year Awards.The awards recognize member companies in five categories: Business with fewer than 50 Employees; Business with more than 50 Employees; Community… |

CEO News | 02/06/2026New Benefit Gives Members Access to Speakers Through TalkadotCenterState CEO is excited to introduce a new member benefit through a partnership with Talkadot (www.talkadot.com), a data-driven speaker booking platform. CenterState CEO members now have unique access to Talkadot, providing a… |